Cobo Argus Weekly Digest #7

Berachain Airdrop Tactics and Frontrunning EigenLayer Restaking Spot with Cobo Argus

Welcome to the 7th edition of Cobo Argus Weekly Digest Newsletter, now more dynamic than ever. This week, there's been quite a buzz around Bera—it feels like we're right back to a DeFi summer vibe 🌴💿📼🎶

The Berachain 🐻⛓️ market vibe check? A bold YES.

The edge here is that it isn't a short game; it's designed for the long haul, promising an exciting journey ahead. This week we're covering:

Bera's tokenomics introduction

Berachain Testnet Guide 🧵

How to frontrun EigenLayer’s Restaking Spot Ahead of Others

…and more!

Let’s get into it…

Week’s Highlight

Berachain tokenomics intro

The long-anticipated Berachain has finally launched its testnet, Artio.

Despite a challenging launch(admittedly, the testnet took a significant time to cook), it comes at an opportune moment when bull markets are emerging and a Bitcoin spot ETF has been approved. It led to such a surge in popularity for Berachain that its faucet was temporarily exhausted.

The faucet has since been refilled, but the claim size has been reduced from 0.25 $BERA on the first day to 0.05 $BERA. From my recent experience, even after a successful claim, there is now a queue. As a result, the 0.05 $BERA claimed 24 hours ago is still on its way to my wallet.

Berachain follows a Tri-Token model, which consists of 3 tokens: $BERA tokens, used to pay for gas and transaction fees; $BGT as the governance token; and $HONEY, which is a system-native stablecoin pegged 1:1 to the USDC.

When users stake assets, the deposited assets are automatically paired with the native stablecoin $HONEY on the native AMM.

As the governance token in the system, $BGT is non-transferable and can only be earned by providing any kind of governance-support LP within the ecosystem.

Although $BGT is non-transferable, it can be exchanged for $BERA; however, the reverse is not possible – you cannot exchange $BERA for $BGT, meaning you cannot acquire $BGT through purchase. This implies that governance tokens can only be acquired by providing on-chain value (liquidity), not by buying.

This structure could lead to more decentralized governance, as the governance tokens are not for sale and must be earned through a combination of 'time spent' and 'value provided.

Wait, but what can be governed by holding $BGT?

Staking BGT allows you to earn protocol fees and influence the emission of $BGT tokens and other incentive mechanisms within the ecosystem.

Specifically, users can delegate their BGT to validators, who then gain the right to initiate proposals and vote. They also have the right to redistribute staking rewards, such as deciding which LP pools are eligible for BGT emissions. Validators stake the $BGT they receive from delegators to propose blocks and earn block rewards. In return, a portion of these block rewards is shared with the $BGT stakers.

The beauty of this model lies in ensuring that the primary beneficiaries of the value generated within the ecosystem are the ecosystem itself and the long-term participants who, consequently, receive greater rewards.

Berachain Testnet Guide 🧵

Taking action in the testnet early on is an essential step to become eligible for a token airdrop. Here are the step by step guidelines for engaging with this Berachain testnet.

Step 1: Add the BERA Network

Add the BERA Network on Metamask to access the Berachain testnet. You can go to Berachain's testnet site, click on the wallet connect button in the top right corner, and add the BERA Network in Metamask.

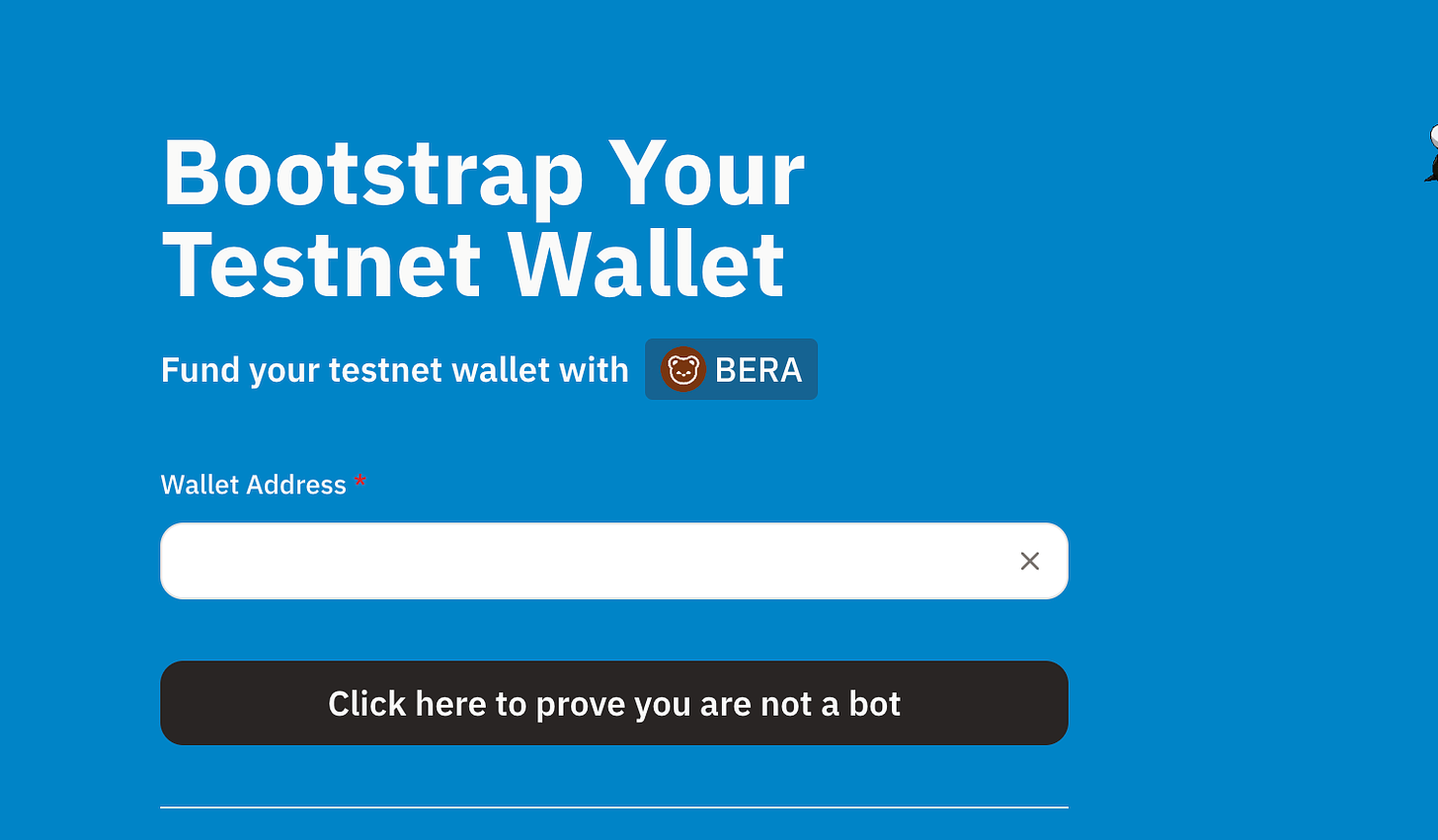

Step 2: Claim faucet tokens

Navigate to the faucet address to grab BERA test tokens. Enter your wallet address in the form field shown in the image below. It's important to note that you can only claim 0.05 testnet $BERA tokens now every 8 hours. Furthermore, Bong Bears NFT holders have an exclusive channel where they can go to this website to claim additional BERA test tokens.

Step 3: Actionables

1. BEX: Berachain DEX

Visit https://artio.bex.berachain.com and launch the app (Enter App).

BEX is the native DEX on Berachain, supporting trading, pool creation, and liquidity providing. Users can perform the following operations:

(a) Swap tokens, supporting $BERA, $HONEY, $WBTC, $WETH, $STGUSDC

Swap $BERA for $STGUSDC, which then can be used in the stablecoin protocol Honey

Swap $BERA for $HONEY, which then can be used in Berachain's native money market Bend and the native perpetual market Berps

Swap $BERA for other supported tokens

(b) Wrap

Wrap $BERA into $WBERA

(c) Pools

Create a liquidity pool:

• Select a token pair and assign weights

• Set the pool fees

• Establish initial liquidity

Pool - LP for existing pools:

• EARN BGT

• Opt for either multi-token or single-token liquidity provision

• Receive a receipt token - representing your share of the entire pool

2. Stablecoin: Honey

Visit https://artio.honey.berachain.com

(a) Approve minting - Opt for either infinite approval or specify a particular amount.

(b) Mint $HONEY using $STGUSDC

(c) Redeem $STGUSDC with $HONEY

Please be aware that a fee of 0.50% is charged for both minting $HONEY and redeeming STGUSDC, even though they are exchanged at a 1:1 ratio.

3. Money Market: BEND

Visit https://artio.bend.berachain.com/dashboard

(a) Supply assets

(b) Borrow $HONEY and earn BGT

4. Perp Market: BERPS

Visit https://artio.berps.berachain.com/berpetuals

(a) Perp features

• Execute market orders and limit orders

• Test the leverage feature—BERPS offers up to 100x leverage(b) Vault

• Deposit $HONEY to receive $bHONEY - Earn $BGT

• Receive transaction fees from traders

5. Governance:BGT Station

Visit https://artio.station.berachain.com

Note: You must hold $BGT to perform operations in this section.

(a) Access ‘My BGT’

➡️ Check the $BGT tokens you’ve accumulated

(b) Delegate

➡️ Delegate $BGT to a validator of your choice

➡️ Redelagate to another validator if desired

(c) Governance

➡️ Create proposals

➡️ Vote on existing proposals

(d) Redeem

➡️ $BGT can be redeemed at a 1:1 ratio for $BERA

➡️ The reverse operation is not possible

Finally, after completing the above actionables, you can also go to the official Berachain page on Galxe to claim an NFT as proof of participation.

How to Frontrun EigenLayer's Restaking Spot Ahead of Others

EigenLayer will be adding support for three new LSTs at 12 PM Pacific Time on January 29, namely Frax Ether (sfrxETH), Mantle Staked Ether (mETH), and Liquid Staked Ether (LsETH). In line with this, EigenLayer will reopen for restaking at the existing cap of 200k ETH for each LST.

The restaking mechanism of EigenLayer has opened up the imagination for expanding the trust layer of Ethereum. Coupled with the proposed generalized DA solution, EigenDA, the market currently has very high expectations for the valuation and airdrops of EigenLayer.

Farming on EigenLayer is possible through Native Restaking, which involves running your own validator node with at least 32 ETH, or through Liquid Restaking, a more accessible route with no minimum requirement, supporting derivatives like stETH, rETH, cbETH, and others.

EigenLayer's liquid restaking has a strict TVL cap that is quickly filled whenever new assets are added, and it is expected to be swiftly reached again with the upcoming reopening.

With Cobo Argus's automated and customized bots, users can set up monitoring alerts and pre-authorize deposits, enabling ETH LST holders to promptly deposit their LST into EigenLayer as soon as the pool goes live.

For step-by-step instructions on how to proceed, please refer to this guide .

➡️ BendDAO is developing 'Debt Swap', a feature for users to swap borrowed positions between ETH and USDT for enhanced borrowing flexibility.

➡️ Taiko has introduced Katla, its last testnet, with a mainnet launch slated for early 2024. Katla combines Optimistic and ZK-rollups to cater to high-performance, cost-efficient decentralized apps.

➡️ Blur is set to launch ThrusterFi, a native DEX based on Blast L2, with more details coming soon.

➡️ Robinhood has listed all 11 spot BTC ETFs on its trading app for clients with retirement and brokerage accounts.

➡️ Coinbase partners with the African local stablecoin exchange Yellow Card to expand into the African market, with an initial pilot in 20 countries across the continent. This means that from February, more than half of Africa's population will be able to purchase USDC on Base through the Coinbase Wallet app and send stablecoins for free via email and popular messaging applications like WhatsApp, iMessage, and Telegram.

➡️ The Lido community proposes the development of its own Layer 1 blockchain.

➡️ Rabby posted a tweet, hinting that a snapshot for an airdrop may be imminent.

➡️ Frame is set to officially launch on January 31st, with this phase of the airdrop focusing on developers and creators.

⚠️Risk warning: Frame, being a sought-after airdrop project, is a prime target for sophisticated phishing schemes and asset drainers.

These scammers frequently set up counterfeit accounts that closely mimic official ones, occasionally even managing to get them verified. They might post replies to official announcements with links to what seems to be an authentic airdrop inquiry site, which in reality is a phishing trap. A telltale sign of such scams is the disabling of the reply function on Twitter, which hinders victims from commenting to alert and protect others from falling for the same deceit.

➡️ Starknet distributes STRK to open source contributors

➡️ Zuzalu will collaborate with Gitcoin and utilize Gitcoin's Grants Stack to fund public goods, aiming to foster the growth of derivative activities (Zu-villages) and support technology-driven projects (digital public goods). The first quarter's quadratic funding round will take place from January 15 to February 15, 2024.

➡️ The issuer of USDC, Circle, has secretly filed for an IPO in the United States. Circle has not yet disclosed the estimated valuation for the IPO, but stated that they will proceed with the IPO based on market conditions and other factors once the U.S. SEC completes its review process.

About Cobo Argus

Cobo Argus is an institutional-grade on-chain digital asset management solution. Built on top of Safe{Wallet} (previously Gnosis Safe), Cobo Argus provides unparalleled security, workflow efficiency, and risk management for interacting with DeFi protocols. Cobo Argus offers a comprehensive suite of powerful features including multi-signature security, on-chain role-based access controls, granular permissions at function and parameter levels, advanced DeFi bots, single-signature authorizations, automated risk monitoring, and more. Cobo Argus supports all open-source DeFi protocols on compatible blockchains.

Website: https://www.cobo.com/argus

Twitter: @Cobo_Global

Telegram Channel: Cobo’s Narratives

Disclaimer: All information provided by Cobo Argus on or via this publication is for information purposes only and is not, and does not constitute or intend to constitute, investment advice or any investment service. The information provided comes from the best sources, however Cobo Argus cannot be held responsible for any errors or omissions that may emerge. Readers and recipients are requested to consult with professional legal, tax, accounting, investment advisors before making any material decisions.