Today is a new era. Pre-ETF vs Post-ETF. Definitely a crazy vibe.

Yet, we must ponder, what unfolds as the next chapter in our Post-ETF reality? This is what we'll explore in today's newsletter.

ETFs are more powerful than any catalyst

Today, the SEC approved Spot Bitcoin ETFs, with ETFs from all 11 applicants receiving approval. This is a significant development for the cryptocurrency industry as it creates new opportunities for investors to gain exposure to Bitcoin, the world's leading digital currency.

Following the news, the crypto market experienced a surge, with Ethereum surpassing $2,600, up 12% in 24 hours. Other Ethereum-related tokens also saw gains: OP hit a new high at $4.13, up 9.8%; PENDLE jumped 23.9%; ENS climbed 30%; and ARB increased by 22%.

Bitcoin, however, saw a modest uptick, currently trading at $46,454, a 0.7% rise in the past day.

It is widely believed that the approval of a Bitcoin spot ETF could trigger a 'sell the news' event, with traders potentially offloading BTC upon the announcement. The rationale behind this is that the current Bitcoin price may have already incorporated the anticipated ease of access for institutional investors through a spot ETF.

The saying "buy the rumor, sell the news" describes a pattern where traders purchase assets on speculation of an event and sell them after the event materializes, often resulting in a price drop as profits are taken.

A day before the official sanctioning of the Bitcoin Spot ETF, a tweet from the SEC's account falsely declared that all Bitcoin ETFs had been approved. Gary Gensler later confirmed the account had been hacked and that the Bitcoin ETFs had not been approved. This erroneous announcement propelled the crypto market into a state of high volatility, with a dramatic rise and fall in BTC prices shortly after the tweet.

However, the immediate market response—BTC prices rapidly rising then falling following the SEC's tweet about the spot Bitcoin ETF approval—appeared to be an early indication of a "Sell The News" trend.

Let's rewind to that moment. BTC jumped above $47,800 on the fake tweet of SEC ETF approval, then fell to around $45,600. It was trading at $46,616 before the tweet. However, after SEC Chair Gensler clarified that their Twitter had been hacked and no ETFs were approved, the price dropped further, hitting a low of $44,900.

What comes next after BTC spot approval?

So in a post-ETF world, what’s the next narrative? And where will the funds rotate next?

After the Bitcoin ETF is approved, institutions like BlackRock, Fidelity, and VanEck will become the best 'salespersons' for cryptocurrencies, not only bringing new money into the crypto industry but also shining a spotlight on the next big narrative-Ethereum.

With the Bitcoin ETF's green light, heavyweights such as BlackRock, Fidelity, and VanEck will become the best 'salespersons' for cryptocurrencies, infusing fresh investments into the sector and directing attention to Ethereum as the upcoming major narrative.

And with the approval of the BTC ETF + the impending Cancun upgrade, the market has shifted its narrative back to Ethereum and its second layer solutions. Notably, the Dencun upgrade will add blob space on L1 Ethereum. Economically, EIP-4844 will create a separate transaction fee market for blobs. Post-EIP-4844, Layer 2 and Layer 1 fee markets will operate independently, leading to competition among Layer 2s for blob storage. Following this, meme coins and altcoins are likely to see movement. NFTs are expected to rise following this (theoretically).

Economist Alex Kruger suggests that the upside for Bitcoin post-approval is limited and that the market focus will pivot towards the potential ETH ETF approval.

DiscusFish, the co-founder of Cobo, suggests that after a landmark Bitcoin ETF approval, the focus should shift to other potential ETF products, such as Ethereum ETFs. He also highlights the importance of keeping an eye on how smaller countries accumulate cryptocurrency reserves and how cryptocurrencies are being used daily in developing countries, particularly by the Gen-Z demographic in high-inflation areas.

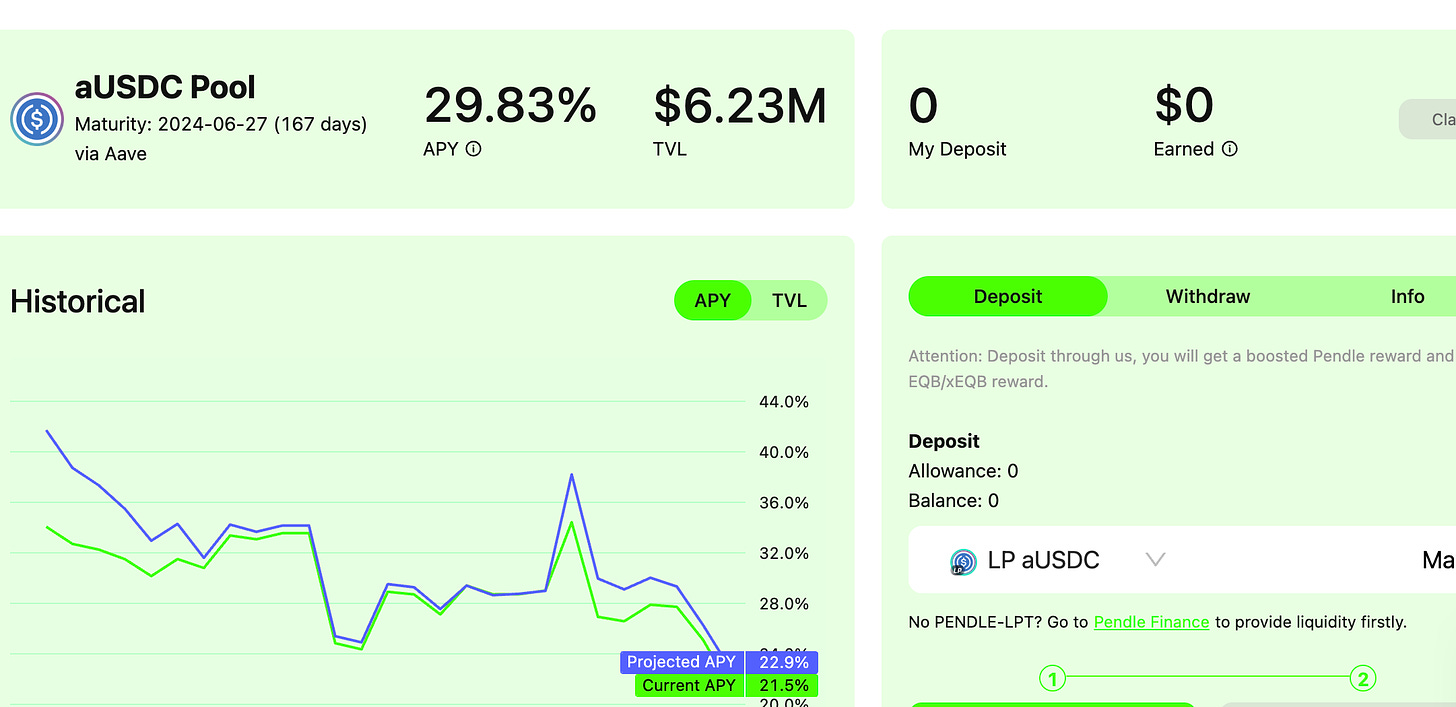

🌽 The aUSDC pool available on Pendle via equilibria.fi/stake now yields an APY of 30%. The aUSDC is securely pegged on a 1:1 basis to the USDC held in the Aave protocol.

Stay tuned for the upcoming launch of the eqb's Claim bot by Cobo Argus 👀

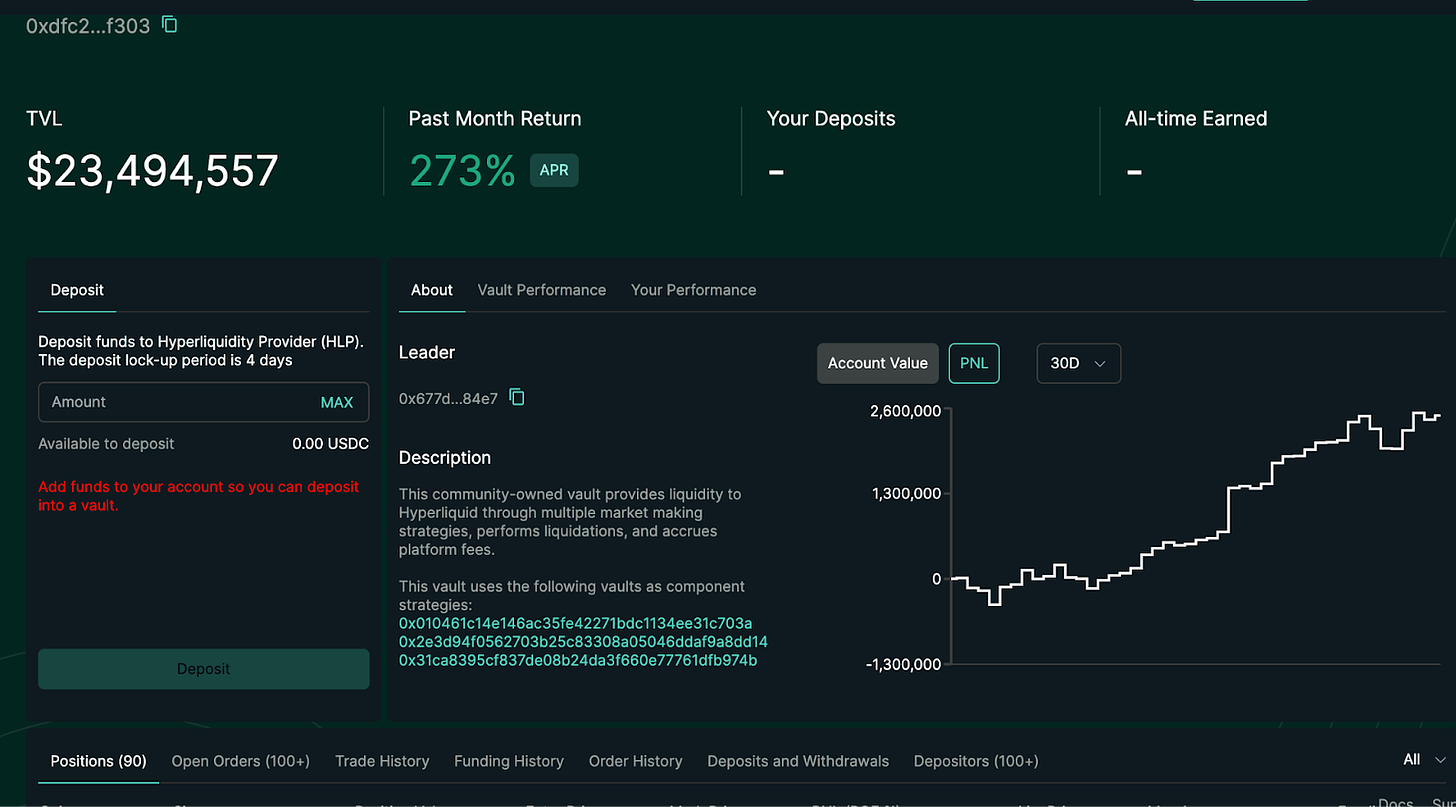

🌽 Hyperliquid Offers Dual Rewards: 273% APR on Stablecoin Deposits and Airdrop Opportunity

Hyperliquid, an on-chain order book running on its Layer 1 infrastructure, is currently yielding a 273% APR on stablecoin deposits. In addition, depositors are becoming eligible to receive Hyperliquid points through an airdrop.

⚠️ Please note: The Hyberliquid model is essentially about providing capital for Hyberliquid to run its own market-making strategies, which carries a certain risk of loss.

➡️ OpenSea unveiled a new self-custodial wallet

OpenSea has rolled out a Privy-powered feature that lets users create self-custodial crypto wallets using only their email, bypassing the need for additional wallet extensions. The wallet is designed to integrate with OpenSea's platform, allowing for straightforward trading and management of cryptocurrencies and NFTs.

➡️ EigenLayer is expanding its offerings by introducing three new Liquid Staking Tokens (LSTs): Frax Ether (sfrxETH), Mantle Staked Ether (mETH), and Liquid Staked Ether (LsETH), while also increasing the capacity for restaking on January 29.

➡️ The Chiado testnet of Gnosis Chain is scheduled for a hard fork on January 31, 2024, at 18:15:40 UTC, aligning with the Ethereum roadmap and paving the way for EIP-4844: Proto-Danksharding.

➡️ OpenAI is set to debut a GPT Store, as revealed by a developer note reported by The Information. This platform will enable users to distribute and monetize their custom AI chatbots built on GPT-4, requiring no programming skills.

➡️ The Arbitrum community initiated voting on the "Long-Term Incentive Pilot Program

Arbitrum is initiating a Long Term Incentives Pilot Program, aiming to allocate 25M-45M ARB to protocols on its platform, with the exact amount to be decided by a DAO vote. This 12-week trial is intended to address the top three concerns from STIP Round 1 and to evaluate new incentive strategies before committing to a more permanent arrangement.

➡️ Base's released the 2024 roadmap:

Slashing transaction fees below $0.01.

Standardizing and funding ERC4337 bundler and paymaster.

Exploring initiatives like EIP-3074 and EIP-5003 for wallet migration.

Partnering with Coinbase and others to adopt smart wallets.

Integrating local currency stablecoins and onboarding users and products with Coinbase collaboration.

➡️ Starknet's Alpha 0.13.0 update, backed by 99.8% of community votes ,intends to introduce the use of the STRK token for transaction fee payments.

➡️ Synthetix rolled out Andromeda on Base, simultaneously dedicating 40% of Perps V3 fees for the Buyback and burning of $SNX tokens via contracts inspired by yearn.finance.

➡️ The draft Pyth DAO Constitution is ready for community feedback, preceding on-chain voting for ratification. It addresses governance roles such as setting oracle fees, reward mechanisms for data providers, approving software updates, and more.

➡️ Cosmos's proposal to decrease the InflationMin parameter to 0% from 7%.If the proposal passes, once the 67% goal of bonded ATOM is reached, the inflation rate will trend towards 0%.

➡️ VanEck pledges 5% of potential spot BTC ETF profits to BTC core developers

About Cobo Argus

Cobo Argus is an institutional-grade on-chain digital asset management solution. Built on top of Safe{Wallet} (previously Gnosis Safe), Cobo Argus provides unparalleled security, workflow efficiency, and risk management for interacting with DeFi protocols. Cobo Argus offers a comprehensive suite of powerful features including multi-signature security, on-chain role-based access controls, granular permissions at function and parameter levels, advanced DeFi bots, single-signature authorizations, automated risk monitoring, and more. Cobo Argus supports all open-source DeFi protocols on compatible blockchains.

Website: https://www.cobo.com/argus

Twitter: @Cobo_Global

Telegram Channel: Cobo’s Narratives

Disclaimer: All information provided by Cobo Argus on or via this publication is for information purposes only and is not, and does not constitute or intend to constitute, investment advice or any investment service. The information provided comes from the best sources, however Cobo Argus cannot be held responsible for any errors or omissions that may emerge. Readers and recipients are requested to consult with professional legal, tax, accounting, investment advisors before making any material decisions.